- Report: #1230623

Complaint Review: derek anthony nelson - Nationwide

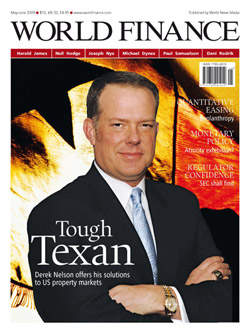

derek anthony nelson anthony nelson, derek nelson, dallas dan, anelsonOU,capital mountain holding corp,rehabdfwproperties,proprietorial trust,agopher.com,anthony nelson 39, anthonynelson3990,dan402040, BE WARNED!!!! Nationwide

hes out of jail and up to his same old tricks, hopefully when he goes to trial later this year they throw away the key.

LATEST ARREST

4/4/2014

current charges

Fraud Security Bus Practice >=$100k

Money Laundering >=$200k

Theft Stolen Prop>=$200k

LAST CHARGES:

IN THE UNITED STATES DISTRICT COURT

FOR THE NORTHERN DISTRICT OF TEXAS

DALLAS DIVISION

________________________________________________

SECURITIES AND EXCHANGE COMMISSION, :

:

Plaintiff, :

:

v. ::

Civil Action No._______

DEREK A. NELSON, CAPITAL MOUNTAIN :

HOLDING CORP., SYSTEMS XXI, ACT I, LLC :

and SYSTEMS XXI, ACT II, LLC, :

:

:

Defendants, and :

:

PLOUTEO, INC. and HOMAIDE REAL ESTATE :

SERVICES CORP., :

:

Relief Defendants, :

Solely for the Purposes of :

Equitable Relief. :

________________________________________________:

COMPLAINT

The Securities and Exchange Commission (“Commission”) files this Complaint against

Defendants Derek A. Nelson (“Nelson”), Capital Mountain Holding Corp. (“CMHC”), Systems

XXI, Act I, LLC (“Act I”), and Systems XXI, Act II, LLC (“Act II”) (collectively, “Defendants”),

and, solely for purposes of equitable relief, Plouteo, Inc. (“Plouteo”) and Homaide Real Estate

Services Corp. (“Homaide”) (collectively, “Relief Defendants”). The Commission alleges:

SUMMARY

1. This is an offering fraud case. From on or about June 2008 through September

2009, Defendants raised at least $25 million through the offer and sale of high-yield notes issued

by CMHC, Act I, and Act II. The offerings were not registered with the Commission.

2. In offering and selling the notes, Defendants represented to investors that the

offering proceeds would be used to buy real property at deeply discounted values, and that the

properties would then be improved, leased, and resold at a profit.

3. Defendants’ representations to investors were false. Instead of investing offering

proceeds in the real estate necessary to support legitimate business operations, Defendants used

most of the funds to: make Ponzi payments to investors; purchase luxury items for Nelson; pay

Nelson’s personal expenses; and pay overhead expenses for various companies controlled by

Nelson. In addition, investor funds, and assets acquired with investor funds, were transferred to

Relief Defendants.

4. In summer 2009, Defendants’ scheme collapsed, payments to investors ceased,

and lien holders began foreclosure proceedings on the properties acquired and held by

Defendants.

5. By this conduct, Defendants have offered and sold securities in violation of the

registration and antifraud provisions of the federal securities laws, specifically Sections 5(a), 5(c)

and 17(a) of the Securities Act of 1933 (“Securities Act”) [15 U.S.C. §§ 77e(a), 77e(c) and

77q(a)] and Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”) [15 U.S.C. §

78j(b)] and of Rule 10b-5 [17 C.F.R. § 240.10b-5] thereunder.

6. The Commission, in the interest of protecting the public from further such

fraudulent activities and harm, brings this action seeking the appointment of a receiver and an

asset freeze, permanent injunctive relief, disgorgement of Defendants ill-gotten gains, plus

prejudgment interest thereon, and civil monetary penalties. Additionally, the Commission is

seeking disgorgement from the Relief Defendants—entities to which Defendants transferred

investor funds and assets.

JURISDICTION AND VENUE

7. The investments offered and sold by Defendants are “securities” under Section

2(1) of the Securities Act [15 U.S.C. § 77b] and Section 3(a)(10) of the Exchange Act [15 U.S.C.

§ 78c].

8. The Commission brings this action pursuant to the authority conferred upon it by

Section 20(b) of the Securities Act [15 U.S.C. § 77t(b)], and Sections 21(d), 21(e), and 27 of the

Exchange Act [15 U.S.C. §§ 78u(d), 78u(e), and 78(aa)].

9. Defendants, directly or indirectly, made use of the means or instruments of

transportation and communication, and the means or instrumentalities of interstate commerce, or

of the mails, in connection with the transactions, acts, practices, and courses of business alleged

herein. Certain of the transactions, acts, practices, and courses of business alleged herein took

place in the Northern District of Texas.

DEFENDANTS

10. Nelson, age 42, is a resident of Fairview, Texas. He owns and controls CMHC,

Plouteo and Homaide. Nelson is also the managing member of Act I and Act II.

11. CMHC is a Texas corporation owned and controlled by Nelson with its principal

place of business in Dallas County, Texas. CMHC has also had offices in Tampa and Las Vegas.

CMHC has never registered an offering of securities under the Securities Act or a class of

securities under the Exchange Act.

12. Act I is a Texas limited liability company managed by Nelson. Its principal place

of business is in Dallas. Act I has never registered an offering of securities under the Securities

Act or a class of securities under the Exchange Act.

13. Act II is a Texas limited liability company managed by Nelson. Its principal

place of business is in Dallas. Act I has never registered an offering of securities under the

Securities Act or a class of securities under the Exchange Act.

RELIEF DEFENDANTS

14. Plouteo is a Nevada corporation controlled by Nelson. Certain properties

purchased by CMHC where titled in the name Plouteo, for no apparent consideration.

15. Homaide is a Texas corporation controlled by Nelson. Homaide received at least

$1.2 million of investor funds, for no apparent consideration.

THE INVESTMENT SCHEME

Fraudulent, Unregistered Note Offerings

16. Between June 2008 and September 2009, Defendants raised at least $25 million

through the offer and sale of notes issued by CMHC, Act I, and Act II. Hundreds of investors

residing in several states (including Texas), Canada, and Australia purchased the notes. The note

offerings were not registered with the Commission.

The CMHC Note Offering

17. In about June 2008, Nelson began marketing CMHC notes to investors. The

notes were marketed via CMHC’s website (www.capitalmountain.com) and a Canada-based

investment club.

18. CMHC notes promised 18. CMHC notes promised to pay investors a return of 10% interest per month for

three months. Nelson represented to investors that CMHC would use the proceeds from the sale

of the notes to purchase distressed residential real estate – i.e., property on which the owner

could no longer afford to make mortgage payments – significantly below market value. Nelson

told investors that after acquiring the discounted property, he would rehab or rent it, and then sell

the property at or near its true value, thereby generating the returns promised to investors.

19. Investors in CMHC notes typically wired their investments to a CMHC bank

account. Once investor funds were received, Nelson and CMHC provided the investors with

written information on the note program, including the promissory notes.

20. Nelson and CMHC raised at least $15 million from the sale of the CMHC notes.

The Act I and Act II Note Offerings

21. In about October 2008, Nelson began offering notes issued by Act I and Act II.

The notes were marketed via the Act I and Act II website, www.systemsxxi.com, and a Canadabased

investment club. Nelson also persuaded many CMHC investors to roll their CMHC

investments into Act I and Act II investments.

22. Prospective Act I and Act II investors were given private placement memoranda,

which claimed, among other things, that: (1) the notes paid 18% annually for two years (Act I) or

21% annually for five years (Act II); (2) 90% of the offering proceeds would be used for

property purchases or “note development,” with the remaining 10% to be used for payroll,

marketing, rent, filing fees, brokerage fees, and other related expenses; and (3) Nelson would be

paid an annual salary of just $24,000.

23. Investors in Act I and Act II notes typically wired their investments to an Act I or

Act II bank account. Those investor funds were then transferred into CMHC bank accounts and

comingled with other investor funds.

24. Defendants raised approximately $10 million from the sale of Act I and Act II

notes.

Defendants Made False Statements and Misrepresentations to Investors

25. Instead of investing note proceeds in distressed real estate as promised,

Defendants misapplied a majority of the funds.

26. Of the $25 million raised from the CMHC, Act I, and Act II offerings: at least $10

million was used to make Ponzi payments to investors; at least $2.6 million was transferred to

Nelson’s personal bank accounts; more than $1 million was used to make a down payment on

Nelson’s personal residence in Fairview, Texas; $80,000 was used by Nelson to purchase a

luxury car; and $1.2 million was transferred to Homaide.

27. Defendants falsely represented to investors that investing in CMHC, Act I and

Act II notes was low risk. In fact, in August 2008, Nelson told investors that the only investment

risk was if he were to die, because no one at CMHC had his expertise. Prospective investors in

Act I and Act II were falsely assured that their investments were secured with first lien positions

on the properties. In fact, Defendants typically acquired the properties by assuming the

mortgages of the prior homeowners or by borrowing funds from a third-party lender. Therefore,

in a majority of the instances, Act I and Act II investors did not have first lien positions on the

properties acquired by Defendants.

28. In summer 2009, with insufficient new investor funds, Defendants were unable to

continue making Ponzi payments to earlier investors or keep mortgages on the properties current.

As a result, payments to investors ceased and lien holders began foreclosing on many of the

properties acquired and held by Defendants.

FIRST CLAIM

Violations of Section 17(a) of the Securities Act

29. Plaintiff Commission repeats and incorporates paragraphs 1 through 28 of this

Complaint by reference as if set forth verbatim.

30. Defendants, directly or indirectly, singly or in concert with others, in the offer or

sale of securities, by use of the means and instrumentalities of interstate commerce and by use of

the mails have: (a) employed devices, schemes, and artifices to defraud; (b) obtained money or

property by means of untrue statements of a material fact and omitted to state a material fact

necessary in order to make the statements made, in light of the circumstances under which they

were made, not misleading; and (c) engaged in transactions, practices, and courses of business

which operate or would operate as a fraud and deceit upon the purchasers.

31. As a part of and in furtherance of their scheme, Defendants, directly and

indirectly, prepared, disseminated, or used contracts, written offering documents, promotional

materials, investor and other correspondence, and oral presentations, which contained untrue

statements of material facts and misrepresentations of material facts, and which omitted to state

material facts necessary in order to make the statements made, in light of the circumstances

under which they were made, not misleading.

32. With respect to violations of Sections 17(a)(2) and (3) of the Securities Act,

Defendants were negligent in their actions regarding the representations and omissions alleged

herein. With respect to violations of Section 17(a)(1) of the Securities Act, Defendants made the

above-referenced misrepresentations and omissions knowingly or with severe recklessness

regarding the truth.

33. By reason of the foregoing, Defendants have violated and, unless enjoined, will

continue to violate Section 17(a) of the Securities Act [15 U.S.C. § 77q(a)].

SECOND CLAIM

Violations of Section 10(b) of the Exchange Act and Rule 10b-5

34. Plaintiff Commission repeats and incorporates paragraphs 1 through 28 of this

Complaint by reference as if set forth verbatim.

35. Defendants, directly or indirectly, singly or in concert with others, in connection

with the purchase or sale of securities, by use of the means and instrumentalities of interstate

commerce and by use of the mails have: (a) employed devices, schemes, and artifices to

defraud; (b) made untrue statements of a material fact and omitted to state a material fact

necessary in order to make the statements made, in light of the circumstances under which they

were made, not misleading; and (c) engaged in acts, practices, and courses of business which

operate or would operate as a fraud and deceit upon purchasers, prospective purchasers, and any

other persons.

36. As a part of and in furtherance of their scheme, Defendants, directly and

indirectly, prepared, disseminated, or used contracts, written offering documents, promotional

materials, investor and other correspondence, and oral presentations, which contained untrue

statements of material facts and misrepresentations of material facts, and which omitted to state

material facts necessary in order to make the statements made, in light of the circumstances

under which they were made, not misleading.

37. Defendants made the above-referenced misrepresentations and omissions

knowingly or with severe recklessness regarding the truth.

38. By reason of the foregoing, Defendants violated and, unless enjoined, will

continue to violate Section 10(b) of the Exchange Act [15 U.S.C. § 78j(b)] and Rule 10b-5

thereunder [17 C.F.R. § 240.10b-5].

THIRD CLAIM

Violations of Sections 5(a) and 5(c) of the Securities Act

39. Plaintiff Commission repeats and incorporates paragraphs 1 through 28 of this

Complaint by reference as if set forth verbatim.

40. Defendants, directly or indirectly, singly and in concert with others, have been

offering to sell, selling and delivering after sale, certain securities, and have been, directly and

indirectly: (a) making use of the means and instruments of transportation and communication in

interstate commerce and of the mails to sell securities, through the use of written contracts,offering documents and otherwise; (b) carrying and causing to be carried through the mails and

in interstate commerce by the means and instruments of transportation, such securities for the

purpose of sale and for delivery after sale; and (c) making use of the means or instruments of

transportation and communication in interstate commerce and of the mails to offer to sell such

securities.

41. As described above, no registration statements were ever filed with the

Commission or otherwise in effect with respect to these transactions and offerings.

42. By reason of the foregoing, Defendants have violated and, unless enjoined, will

continue to violate Sections 5(a) and 5(c) of the Securities Act [15 U.S.C. §§ 77e(a) and 77e(c)].

RELIEF REQUESTED

WHEREFORE, Plaintiff respectfully requests that this Court:

I.

Permanently enjoin Defendants from violating Sections 5(a), 5(c) and 17(a) of the

Securities Act and Section 10(b) of the Exchange Act and Rule 10b-5 thereunder.

II.

Order Defendants to disgorge an amount equal to the funds and benefits they obtained

illegally, or to which they are otherwise not entitled, as a result of the violations alleged, plus

prejudgment interest on that amount.

III.

Order Defendants to pay civil monetary penalties in an amount determined as appropriate

by the Court pursuant to Section 20(d) of the Securities Act [15 U.S.C. § 77t(d)] and Section

21(d) of the Exchange Act [15 U.S.C. § 78u(d)] for the violations alleged herein.

Order such further relief as this Court may deem just and proper.

Dated this 20th day of November 2009.

Respectfully submitted,

s/ Robert Long

Robert Long

Arizona Bar No. 019180

United States Securities and Exchange Commission

Burnett Plaza, Suite 1900

801 Cherry Street, Unit 18

Fort Worth, Texas 76102

Telephone: (817) 978-6477

FAX: (817) 978-4927

E-mail: [email protected]

Attorney for (Plaintiff) Securities and

Exchange Commission

SEC INFORMATION AND ARTICLES:

SEC Busts Alleged $25M Ponzi Scam

DALLAS (CN) - Derek Nelson ran a $25 million Ponzi scam through his so-called real estate company, Capital Mountain Holding Corp., the SEC says in Federal Court. Nelson, of Fairview, Texas, promised he could buy property at a discount, fix it up and lease it, but he spent the money on himself until the scheme collapsed this summer, the SEC says.

The SEC sued Nelson, 42, Capital Mountain, and his other companies, Systems XXI, ACT I LLC, Systems XXI ACT II, and relief defendants Plouteo and Homaide Real Estate Services.

"Instead of investing offering proceeds in the real estate necessary to support legitimate business operations, defendants used most of the funds to make Ponzi payments to investors; purchase luxury items for Nelson; pay Nelson's personal expenses; and pay overhead expenses for various companies controlled by Nelson," the federal complaint states. "In addition, investor funds, and assets acquired with investor funds, were transferred to relief defendants.

"In summer 2009, defendants' scheme collapsed, payments to investors ceased, and lien holders began foreclosure proceedings on the properties acquired and held by defendants."

The SEC says there were hundreds of victims.

It seeks disgorgement, penalties and an injunction.

November 24, 2009 – The SEC alleges that Derek A. Nelson ran a Ponzi Scheme using fictitious companies: Capital Mountain Holding Corporation (“CMHC”), Systems XXI, Act I, LLC, and Systems XXI, Act II, LLC. In a Complaint filed last week in federal court for the Northern District of Texas, the SEC brought civil claims against Nelson, CMHC, Act I, and Act II. The SEC also named two other Nelson entities, Plouteo, Inc. and Homaide Real Estate Services, Inc., as relief defendants. According to the complaint, Nelson’s scam enticed hundreds of investors and raised over $25 million from June 2008 through September 2009.

In June 2008, CMHC, based in Dallas, Texas, began offering promissory notes purportedly to raise capital for investment in distressed homes. Nelson, 42 from Fairview, Texas, told  investors that he would use the money to purchase these properties at a discount and then renovate or rent them and eventually sell them at a profit. Nelson gathered investors through vigorous internet marketing and a Canadian-based marketing firm. The CMHC notes promised returns of 10% per month for three months. CMHC allegedly raised $15 million from these sales.

investors that he would use the money to purchase these properties at a discount and then renovate or rent them and eventually sell them at a profit. Nelson gathered investors through vigorous internet marketing and a Canadian-based marketing firm. The CMHC notes promised returns of 10% per month for three months. CMHC allegedly raised $15 million from these sales.

In October 2008, Nelson began offering similar notes from Act I and Act II. The Act I notes offered 18% yearly returns for two year investments and the Act II notes 21% yearly returns for five years. These notes also declared that 90% of investor funds would be used to purchase and rehab properties. According to the SEC, Nelson raised at least $10 million from sales of Act I and Act II notes.

Nelson also convinced many CMHC investors to rollover their notes into Act I and Act II notes claiming they were more secure. Nelson also told investors that Act I and Act II would loan money to CMHC in exchange for first lien positions on the properties.

In reality, as alleged by the SEC, Nelson used a majority of the capital raised to make interest and principal redemption payments to earlier investors. He also apparently used about $3.6 million finance his lifestyle, including a $1 million home in Fairview. Also, it appears that $1.2 million was transferred to Homaide.

It appears that CMHC did purchase several properties, but most of them were still subject to prior mortgages and Act I and Act II were at best second in line. Eventually, in the summer of 2009, the scheme crumbled and most of CMHC’s properties were foreclosed on as investor contributions dwindled.

The U.S. District Court for the Northern District of Texas has granted injunctions against all defendants and entered orders to freeze the assets of Nelson and CMHC and to appoint a receiver for these assets.

Source: SEC

SEC Sues Dallas Company for Conducting Fraudulent $25 Million Promissory-Note Offering and Obtains the Appointment of a Receiver

The Commission alleges that beginning in 2008 Nelson offered and sold promissory notes issued by CMHC, Act I, and Act II. The notes were marketed through a website and by a Canada-based investment club. The proceeds were to be used to buy distressed properties. Nelson told investors that after acquiring the properties at a discount, he would improve, rent, and resell them at prices closer to the properties' true value, thereby generating the returns promised to investors. The CMHC notes promised 10% per month interest for three months. The Act I and Act II notes that paid 18% per annum for two years (Act I) and 21% per annum for five years (Act II). Nelson promised that 90% of Act I and Act II funds would be used to acquire real estate and to rehabilitate the properties for rental or resale. Nelson further represented that Act I and Act II would loan money to CMHC in exchange for first lien positions on CMHC's properties. Nelson persuaded many of the CMHC noteholders to rollover their CMHC note principal into the Act I and Act II notes because they would be "more secure."

Ponzi Scheme Alleged In Multi-Million-Dollar Fraud Based on Real Estate Investments

Derek A. Nelson, an Oklahoma resident who allegedly operated a Ponzi scheme based on a real estate investment program, has been indicted on charges of securities fraud, theft, and money laundering in Collin County State District Court. The March 25 indictment alleges that Nelson raised $11.9 million from U.S. investors who purchased investment contracts, notes, and other securities. Nelson sold and offered for sale unit shares in a series of programs known as the CMHC Investment Program.

According to the indictment, Nelson failed to disclose that CMHC was not earning sufficient profits from the buying, rehabilitating, renting and sale of profits to make monthly payments to investors. Nelson didn’t disclose to investors in CMHC that some of the profits and principal payments to investors were paid with funds from other investors, and he failed to disclose that investors’ funds paid for his personal expenses and members of his family.

The Collin County District Attorney’s Office has appointed State Securities Board enforcement attorneys Tina Lawrence, Matthew Leslie, and Dale Barron as special prosecutors. Financial examiner Letha Sparks of the State Securities Board is assisting in the prosecution.

IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION SECURITIES AND EXCHANGE COMMISSION

Plaintiff,

v.

DEREK A. NELSON, CAPITAL MOUNTAIN

HOLDING CORP., SYSTEMS XXI, ACT I, LLC

and SYSTEMS XXI, ACT II, LLC,

Defendants, and

PLOUTEO, INC., HOMAIDE REAL ESTATE

SERVICES CORP. and RG RETIREMENT, INC.

Relief Defendants

Solely for the Purposes of

Equitable Relief

:

:

Civil Action No. 3:09-cv-02222-F

RECEIVER’S STATUS REPORT

(April 1, 2010 through June 30, 2010)

Keith M. Aurzada as Receiver (the “Receiver”) for DEREK A. NELSON, CAPITAL

MOUNTAIN HOLDING CORP., SYSTEMS XXI, ACT I, LLC and SYSTEMS XXI, ACT II,

LLC, (“Defendants”), and PLOUTEO, INC., HOMAIDE REAL ESTATE SERVICES CORP.,

and RG Retirement, Inc. (“Relief Defendants”, and together with the Defendants, the

“Receivership Companies”), hereby files his Status Report.

BACKGROUND

1. Prior to the initiation of the above-captioned action by the Securities and Exchange Commission (“Commission”), Defendants raised at least $25 million through the offering and selling of high yield notes and equity interests. In offering and selling the notes, the Defendants represented to investors that the offerings and proceeds would be used to buy real property at deeply discounted values, and that the properties would be improved, leased, and resold at a profit.

2. As the Receiver has conducted his investigation, it has become apparent that the Defendants’ means for acquiring properties was not to pay cash for the majority of properties. Instead, the Defendants took deeds to individual properties subject to pre-existing mortgage indebtedness. It is unclear what, if anything, homeowners were paid in return for the deeds, other than a promise by Capital Mountain Holding Corp. (“Capital Mountain”) and the other Defendants to make payments due under the individual, property level mortgages.

3. In the summer of 2009, Defendants’ scheme collapsed, payments to investors ceased, and lienholders began foreclosure proceedings on the properties acquired and held by the Defendants. Many of the properties are in dilapidated conditions. Moreover, it is difficult to tell from the Defendants’ records how the properties were acquired, the consideration paid for each of the properties, and the complete transactional history with respect to each property.

4. Since commencing his duties, the Receiver has identified through public record searches most of the lienholders on each of the properties. For each of the last several months, numerous properties have been posted for foreclosure by lienholders who claim to be unaware of this proceeding and the Court’s imposition of a stay of actions against receivership property. Additionally, certain prior owners of properties have attempted to assert ownership rights to properties, through foreclosure or otherwise.