- Report: #1412970

Complaint Review: Westlake Financial - Los Angeles California

Westlake Financial Told new my loan pay off date was for 2/12019, Now starting pay off date 1/22/2020 Los Angeles California

Report Attachments

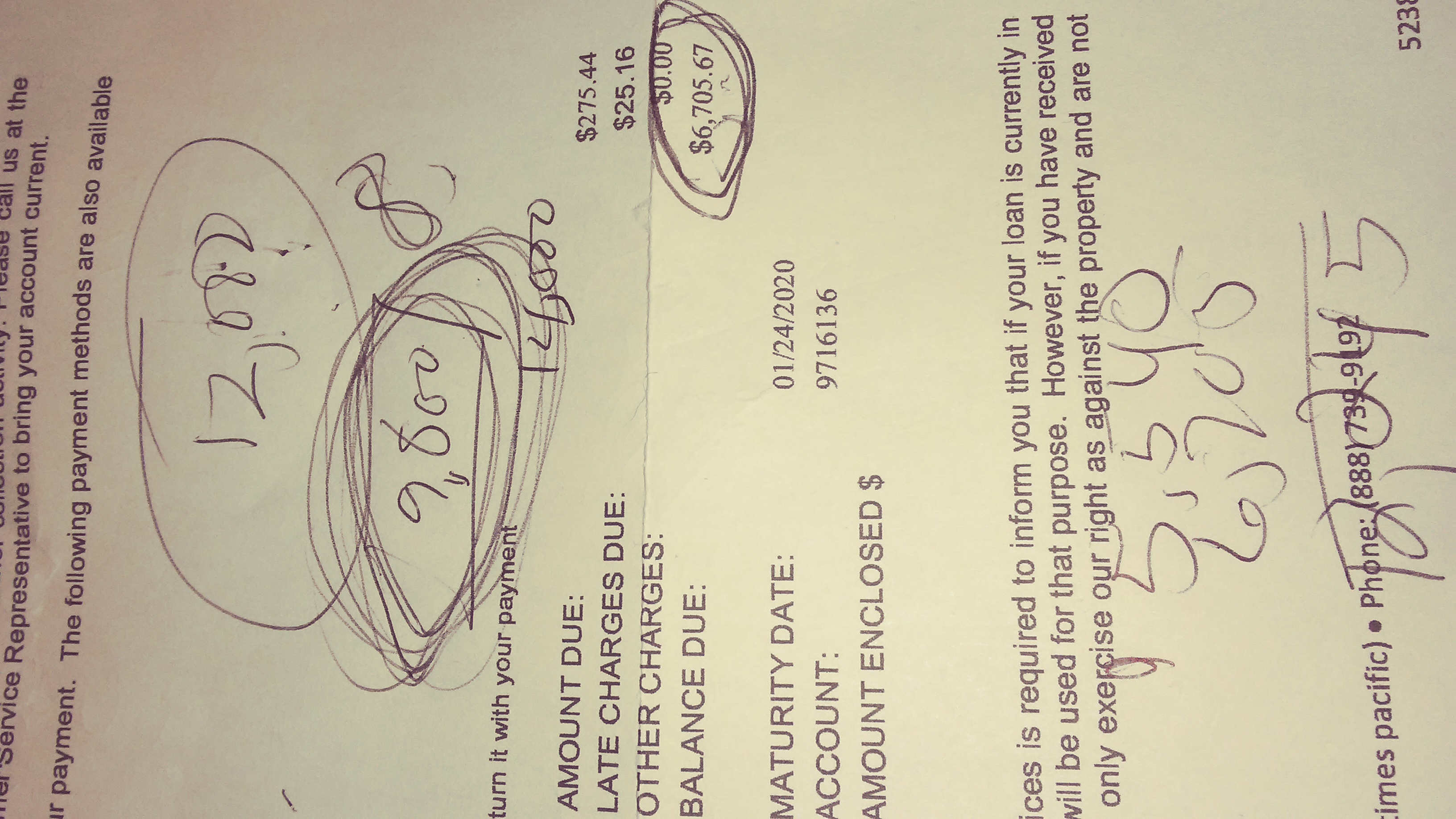

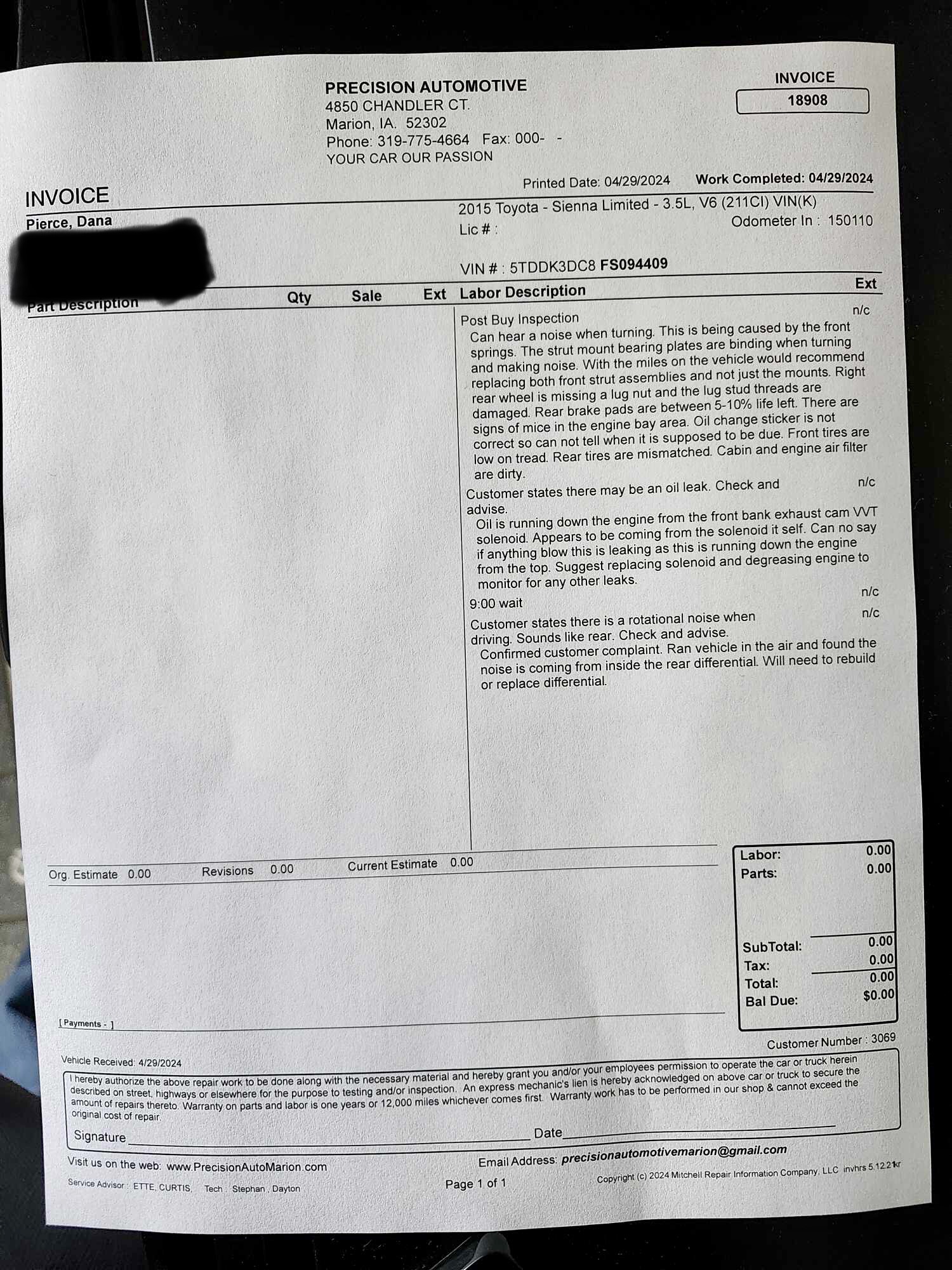

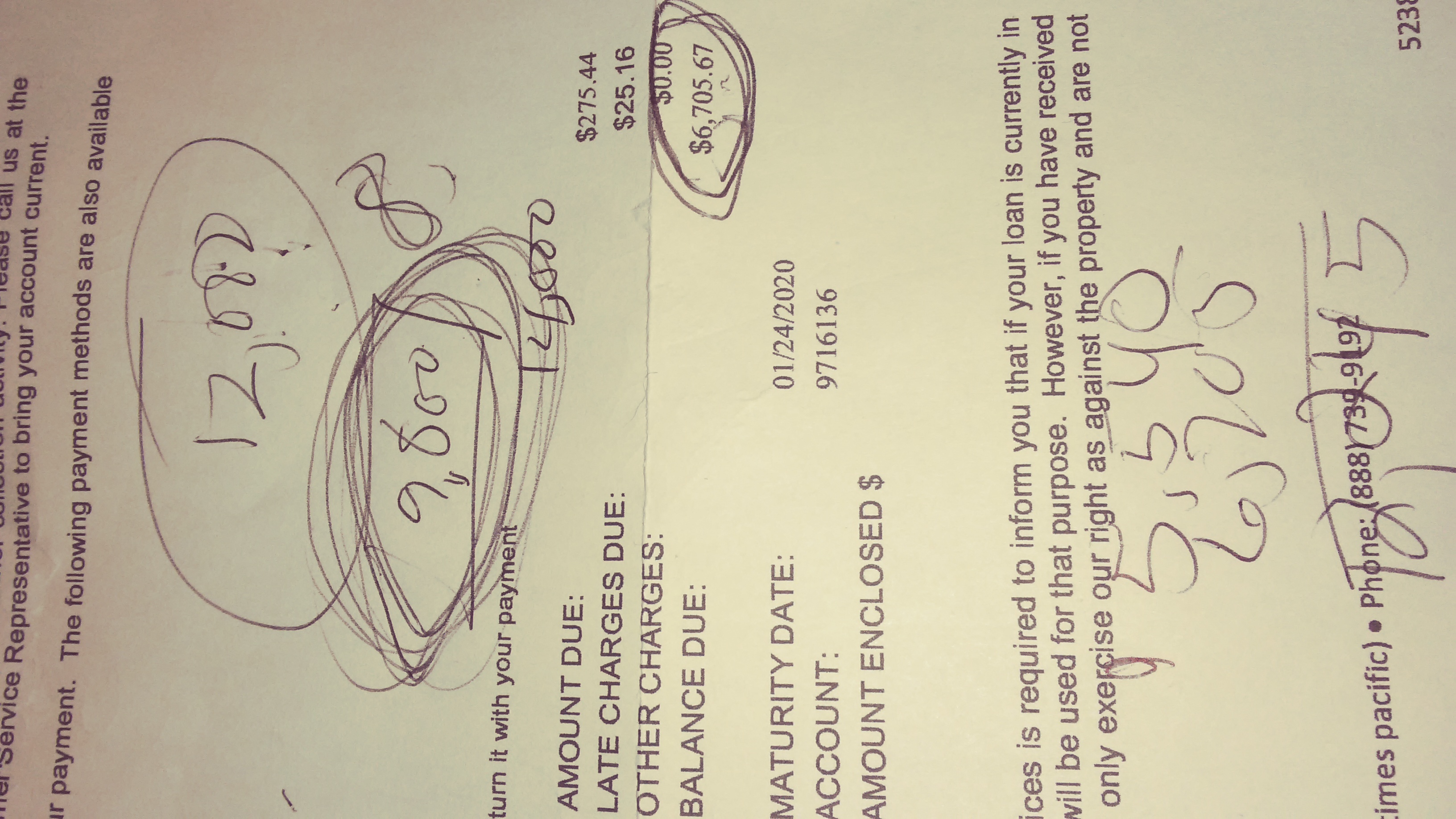

I purchased a 2006 Nissan Exterra . Total price was 8,900.00.. Westlake Financial approved my loan. I have been paying 277.73 for the last 20 months. I recieved a letter today telling me I owe 6,700.00 and my loan will not be paid off until 1/2020 instead of 2/2019... They proceeded to tell me my loan was for 14,000. My loan was written for 8,900.00.. They will not answer my questions as to where the extra 5,000.00 plus got added on.. The Blue Book value is 8,500.09 for the vehicle. Don't know what to do or who to contact. I need help please.

3 Updates & Rebuttals

Pamela

Los Angeles,United States

Customer Experience Team

#2UPDATE Employee

Tue, December 05, 2017

Hi Julie.Thank you for your feedback once again. We appreciate you giving us an opportunity to correct the problem and meet your expectations.

Robert

Irvine,California,

United States

Contract

#3Consumer Comment

Wed, November 22, 2017

What does your ORIGINAL finance contract state?

Based on what you wrote, and the letter you did post, it seems that you may have a history of being delinquent. How many times have you been late(we know of at least one) and how late were you? Have you asked for any sort of assistance such as deferred payments? As each one of those can affect your balance due and maturity date.

This company is a sub-prime finance company, that is they finance people who have not proven they can handle credit. As such you are considred a high risk and charged a higher interest rate, probably above 10% and being close to 20% would not be out of the normal range.

This is important because if your original loan balance was $14,000 in the 20 months you would have paid only a bit over $5500. With the interest that would put your balance around 11-12K, not anywhere near the $6700 they stated.

So getting the original contract and understanding your payment history would provide you with the reasoning.

One other thing you need to be aware of is what the maturity date means. It means that is the date the balance of the loan is due. At your current pace if your maturity date was 2/19 with the current balance of $6700 you are probably still going to owe around $3000. This means in 2/19 you will have to come up with $3000 or risk having the car reposesed. Even a 1/20 maturity looks like you may have a few hundred dollars you are going to have to pay. But again all of this depends on your interest rate and if you do become late at any time while you are paying the loan.

If you have any doubts you can plug your loan information into an amortization calcluator(you can find many on the interet) and see how your payments will be allocated. You can also see how they have been allocated(figuring you were always current).

coast

United StatesQuestion

#4Consumer Comment

Wed, November 22, 2017

The documented loan agreement will resolve any disputes concerning the terms of the loan. The cost of the vehicle is not the issue. The amount financed is the issue. The principal, interest rate and term of the loan determine the total amount to be paid to the lender. It is unlikely that the cost of the vehicle and the amount owed are both $8900. The Kelley Blue Book value is not relevant. Have you had any deferments or late payment penalties on this loan?