- Report: #147075

Complaint Review: Cashier Inc - Belleville Ontario

Cashier Inc

95 College, Belleville, Ontario, Canada

Web:

N/A

Categories:

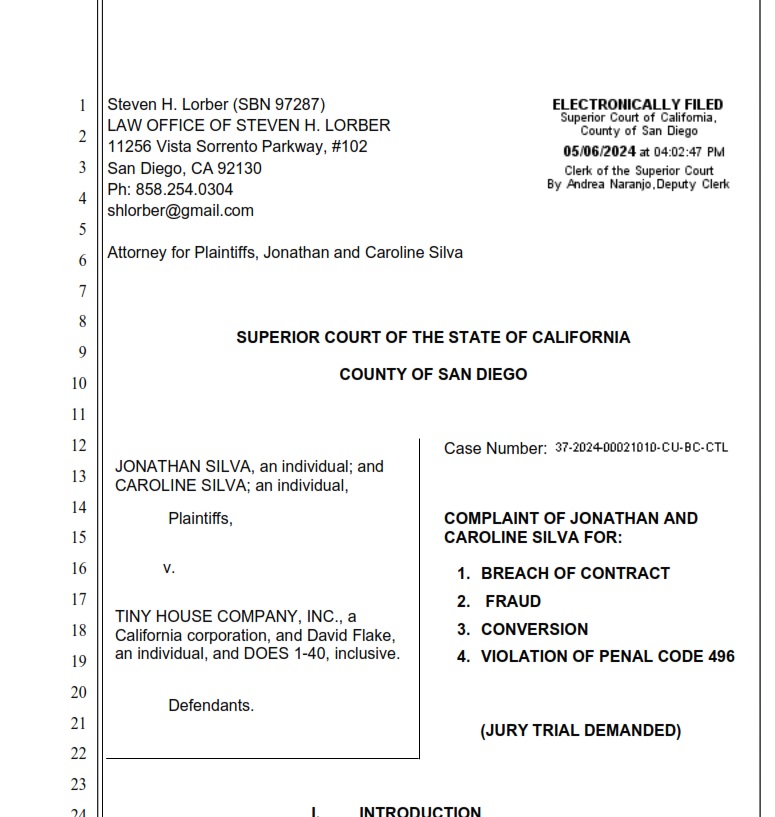

Cashier Inc rip off Toronto Police case-tracking documents obtained by The Intelligencer, Graves arrested charged with a string of offences including keeping a common bawdy house, permitting premises to be used as a bawdy house, procuring illicit sex, and living on the avails of prostitution. Belleville Ontario

Printed from www.intelligencer.ca web site Saturday, July 12, 2003 - 2003 Belleville Intelligencer Investors fuming over Cashier Inc. meltdown

By Derek Baldwin

Friday, July 11, 2003 - 10:00

Local News - Despite repeated ringing of the bell, the door at 50 Penny Lane goes unanswered.

Through tiny diamond-shaped glass windows, a woman can be seen poking her head around the corner of a sunlit room deep inside the finely-appointed 2,500 square-foot home.

But she ignores her callers and disappears from view.

Only steps away from the front porch, a parked SLK 230 Mercedes sports car is parked in the open garage of the grey brick bungalow nestled in this upscale executive neighbourhood on the eastern fringe of Belleville.

It's only one of many costly homes that dot the wooded tranquility here off Old Kingston Road in what is commonly described by local real estate agents as the city's finest subdivision.

Contrary to appearances, this house recently listed on the real estate market for sale at $379,000 is not home to the typical business executive.

It is sanctuary for a man, previously convicted of bawdy house offences, now at the epicentre of a growing international financial investment scandal that has attracted the attention of securities authorities in five American states and the Royal Canadian Mounted Police (RCMP) in Ottawa.

Police said they are investigating the business activities of Tom Graves, a tall, slender 57-year-old man with a ruddy complexion who, by all accounts, is an intelligent opportunist with a proven business acumen that has previously been used on the wrong side of the law. In recent years, he has been imprisoned and has paid stiff court fines for operating what police have described as sophisticated bawdy house operations in Toronto that yielded large amounts of untraceable cash.

Documents obtained by The Intelligencer reveal 387 investors across North America are now pressing authorities for answers as to why some of the millions of dollars they invested in a new venture with Graves as much as $35 million in total have evaporated along with a failed cheque-cashing and payday loan-advance company he founded in Belleville.

Graves's Cashier Inc., located at 95 College St. East in Belleville, filed for bankruptcy June 7, forcing the company into the hands of receiver BDO Dunwoody Ltd. of Toronto.

In bankruptcy papers, Cashier Inc. president Graves signed his name to 26 pages, each listing noteholders who expected him to earn them as much as 36 to 60 per cent in annual returns on their investments.

Investors now worry they may only get cents on the dollar following a cursory investigation by BDO Dunwoody, which has conducted a preliminary forensic audit of the company's remaining assets versus its liabilities.

In an interview, BDO Dunwoody vice-president Clark McKeown said from Toronto that he couldn't divulge details about the Cashier Inc. meltdown.

There isn't a lot that has become public yet other than the meeting of the creditors, said McKeown. The trustee will not divulge private information.

The meeting McKeown referred to was held June 27 at Belleville's Banquet Hall where 40 of the 387 investors gathered for a private anger-filled bear-pit session with BDO Dunwoody to learn what had happened to their money.

Court-appointed trustee BDO Dunwoody, in its preliminary report, said that when it took possession of the failing company and its assets June 7, Cashier's records were in disarray.

A review of Cashier's noteholder files reflects no consistency or completeness in the form of documentation or written exchanges with these noteholders, stated the report.

The receiver said records were in such poor condition that it will be difficult to distinguish between those for Cashier Inc. and its predecessor company Can-Stop Ltd., also owned by Graves, another Belleville-based cheque-cashing and loans outfit that Graves merged into Cashier Inc.

Making matters more complicated, investors are spread far and wide, said the receiver.

BDO Dunwoody said noteholders who sank cash into the company hail from 50 different Canadian and American provincial and state jurisdictions as well as several foreign jurisdictions... the trustee has been contacted by a number of highly-concerned noteholders, many of whom have alleged that in making their investment, they were seriously misled and/or misinformed. The trustee is also aware of several actions brought by one Canadian and five U.S. state authorities which, in some cases, were charging that violations of securities legislation had been committed.

The claims by BDO Dunwoody of government action on both sides of the border are fact, The Intelligencer has learned.

Belleville police said they are aware of the mounting Cashier Inc. matter but are not investigating, because it falls within the purview of the RCMP.

Unofficially, sources within the RCMP said this week that an investigation has been launched into Cashier Inc. and Can-Stop Ltd. by detectives within the Mounties' commercial crimes unit in Kingston.

Officially, however, RCMP spokeswoman Michele Paradis said from Toronto she cannot confirm publicly if federal police are investigating Cashier Inc. on fraud-related complaints by Canadian investors who claim they have been bilked.

Privacy legislation says we can't divulge if a case is underway, said Paradis.

However, as official spokeswoman for RCMP Ontario region, Paradis confirmed no charges have been laid that I know of against Graves or either of his companies in Canada.

In the U.S., state securities authorities have filed charges in their own jurisdictions against Cashier Inc., Graves and American investment broker Victor Kivisels, president of Florida-based Corporate Funding Group Inc.

According to information compiled by BDO Dunwoody, Kivisels allegedly received 35 per cent in commissions, or roughly $10 million, from money raised by his firm across the continent for Cashier Inc.

In a statement, Washington State securities division assistant director Deborah Bortner said a cease and desist order was issued against Cashier Inc. alleging that the company violated the Washington State Securities Act by offering unregistered securities. Cashier is alleged to have used a Florida telemarketing firm Corporate Funding Inc. to offer Cashier's unregistered securities to Washington citizens.

Cashier Inc., it is alleged in documents obtained by The Intelligencer, sent, or caused to be sent, unsolicited e-mail messages to Washington residents seeking investors. The e-mail messages stated that for a $10,000 investment, investors could make 36 per cent annual returns investing in what the respondents (Cashier) called fully secured accounts receivable acquisitions.'

Bortner said Washington officials launched an undercover sting operation and through an Internet surveillance program identified the (alleged) frauds, then our investigators posed as investors and were solicited by (allegedly) fraudulent telemarketing firms. We then had the evidence we needed to shut down the operations.

In the charges, investigators said a salesperson named Crecelius called one Washington resident who returned an electronic form from a Cashier Inc. e-mail and allegedly said that, contrary to American law which only allows payday loan firms to charge 15 per cent interest per $100 borrowed, Canadian laws allow a charge of up to $30 per $100. As a result, Cashier collected a 780 per cent annual return...

The allegations state that Cashier Inc. and its related parties also made material misrepresentations and omissions in the offer. The cease and desist order seeks restitution for Washington investors, injunctive relief to prohibit future violations and fines of $5,000 against each respondent.

Speaking directly to Cashier Inc.'s promise of high rates of return, Bortner said investors need to be especially cautious about promises of high returns with low risk.

Other state authorities have weighed in for a fight against Cashier Inc., including Pennsylvania and Nebraska.

Thomas Sindelar, an official with the Nebraska Department of Banking and Finance, said his state also issued a cease and desist order against Cashier Inc. to permanently prohibit the further offer of (Cashier's) investments and securities.

Aimee Toth, legal counsel for Pennsylvania state's division of enforcement, litigation and compliance, said her government issued an order against Graves's Cashier Inc. and Can-Stop Ltd. to halt business activities there.

In a statement, Toth said the state logged instances in October 2001 in which Cashier Inc. and Can-Stop advertised on a Pennsylvania radio station for payday advance loans and elsewhere offered investment opportunities.

Offering materials indicate that the minimum investment in the agreements is $10,000 with a 12-month term and the amount of the offering is $1.9 million. The agreements are to pay monthly interest at 3 per cent and they are renewable for one additional 12-month term, said Toth. The agreements issued by Cashier are securities which are not registered with the commission under Sect. 201 of the 1972 Securities Act...

The sales pitches, whatever they were, appear to have worked.

According to a list of creditors compiled by BDO Dunwoody, 75 per cent of the $35 million in investments came from American residents with much of the remaining cash coming from Canadian sources, including some from Quinte.

According to the creditors' list filed in bankruptcy court, the total claim by 387 investors tops $20.7 million. A separate $13 million was paid out in the company's infancy in interest to noteholders.

Locally, as many as 35 investors stand to lose $2.5 million they invested in the failed Cashier Inc. firm, the list reveals.

As is done in similar cases, inspectors,' as they are termed, are appointed under BDO Dunwoody from among the investors to inspect paperwork, act as advisors and liaise with the other investors. While BDO Dunwoody is acting as the trustee, it is consulting with the five inspectors on future decisions to reclaim as many assets as possible.

Surviving Cashier Inc. accounting receipts show that the company only claimed $1.6 million in cash profits of the $35 million in capital raised, and that there was a recorded operating cash loss of $17.8 million.

As of June 7, when BDO Dunwoody assumed control of Cashier Inc., the company still had $5.1 million in assets, including $359,996 in cash, $191,258 in loans receivable from customers in good standing, $3.1 million in delinquent accounts now in collections, and roughly $1.5 million in receivables that appear to be recoverable.

The fact that some assets remain on the books offers little solace to some investors.

Marc Abramsky, one of the appointed inspectors, said he has no idea if he will recoup the $120,000 Cdn he invested in 2000.

In an interview from his home, Abramsky said he shares the feelings of many investors who attended the June 27 meeting in Belleville.

We're all dealing with this feeling of gross betrayal... I believe it was gross misrepresentation that was taking place, said Abramsky, who owns and manages Boat Brokers and Charters in Picton.

Abramsky said he has reviewed the bankruptcy documents concerning Cashier Inc. and, coupled with the apparent loss of his hard-earned cash, he feels he has been a made a fool of.

The feeling is our investment has been lost and we are only going to see cents on the dollars. We have been taken advantage of. It would be good to see justice served here,said Abramsky.

Abramsky said his apparent loss is small compared to other Canadian investors as listed in the creditors documents filed by BDO Dunwoody.

Tom Carmichael of Toronto, another appointed inspector, is wondering if he will ever see any of the $800,000 he invested with Cashier Inc.

And a Belleville company, Invest and Beyond Ltd., is trying to recoup $1.2 million it invested.

Even more troubling for investors in Belleville and beyond is word of Graves's questionable past that never came to light when millions of dollars were pouring in from unsuspecting investors.

Court and police documents show that while operating Can-Stop businesses in the mid- to late-1990s, Graves was also involved in illegal business activities in Toronto.

While Graves was operating his Can-Stop cheque cashing and loan advance operation from a second-floor office in Toronto, phones on the premises were also being used to field calls from Johns looking to have illicit sex in as many as five bawdy houses operated by Graves and associates, a police investigation concluded in 1998.

Det. Bernie Delaney heads the 32 Division Plain Clothes Vice Squad on Yonge Street north of Sheppard Avenue.

In an interview this week, he confirmed he headed up a month-long investigation involving 40 of his officers that probed an elaborate prostitution ring overseen, said Delaney, by Graves and family members.

Hundreds of hours of surveillance, phone taps and detective work uncovered a highly sophisticated network of brothels, said Delaney, that were connected by a labyrinth of call-forwarding phone systems to avoid detection.

Considered an expert on the inner workings of prostitution in Canada, Delaney has cracked more than 1,000 prostitution cases since 1972. He said the Graves's operation was among the most well-planned he has seen to this day.

It was very intricate, very well done, said Delaney from Toronto. I have been with the force for 35 years... and I will tell you, this was within the top handful I have ever seen. This was very well organized.

The challenge for Delaney and his less-experienced officers was tracing phone calls to the actual apartments used to provide illicit sex by an estimated 20 call girls aged 23 to 39.

Advertisements with phone numbers were placed in newspapers, but the phone lines were not connected to the bawdy houses, he said.

Rather, when a caller phoned to procure a prostitute, the calls were call-forwarded as many as five times to different locations, bounced as Delaney said, to avoid police tracing the calls and busting down the doors of the illicit sex locations.

To locate the bawdy houses, undercover officers from 32 Division posed as Johns. Prostitutes, as well as runners in the operation who picked up nightly cash receipts, were trailed. Through around-the-clock observation, Delaney said the bawdy houses were located, raided and all players within the organization were charged.

On May 12, 1998, 10 people were arrested in the raids and 68 charges were laid. Delaney said all pleaded guilty to a variety of offences.

According to Toronto Police case-tracking documents obtained by The Intelligencer, Graves himself was arrested seven days later and charged with a string of offences including keeping a common bawdy house, permitting premises to be used as a bawdy house, procuring illicit sex, and living on the avails of prostitution.

Disposition papers show Graves pleaded guilty to several of the charges when he appeared in court, having served 14 days in pretrial custody. He was given an intermittent sentence of 90 days incarceration in a provincial detention centre.

Graves was also ordered by the Toronto court to pay $50,025 in fines.

Delaney confirmed that, at the time of arrest, the investigation estimated the bawdy house operation may have raised as much as $1 million in revenues in as little as two years.

Graves could not be reached by The Intelligencer at his home or by telephone.

In a Jan. 29, 2003, letter to investors, however, Graves defended the failing situation of his company.

The last six months have been very difficult due to investors payouts. We have also had $3.7 million in bad debt. Most of the $3.7 million will come back to us, but this takes time, he wrote.

Cashier has had too much in payouts in the last six months and this has depleted our cash flow leaving us in a position that we are unable to meet our obligations to our investors.

Mondial

St. Michael

Barbados

By Derek Baldwin

Friday, July 11, 2003 - 10:00

Local News - Despite repeated ringing of the bell, the door at 50 Penny Lane goes unanswered.

Through tiny diamond-shaped glass windows, a woman can be seen poking her head around the corner of a sunlit room deep inside the finely-appointed 2,500 square-foot home.

But she ignores her callers and disappears from view.

Only steps away from the front porch, a parked SLK 230 Mercedes sports car is parked in the open garage of the grey brick bungalow nestled in this upscale executive neighbourhood on the eastern fringe of Belleville.

It's only one of many costly homes that dot the wooded tranquility here off Old Kingston Road in what is commonly described by local real estate agents as the city's finest subdivision.

Contrary to appearances, this house recently listed on the real estate market for sale at $379,000 is not home to the typical business executive.

It is sanctuary for a man, previously convicted of bawdy house offences, now at the epicentre of a growing international financial investment scandal that has attracted the attention of securities authorities in five American states and the Royal Canadian Mounted Police (RCMP) in Ottawa.

Police said they are investigating the business activities of Tom Graves, a tall, slender 57-year-old man with a ruddy complexion who, by all accounts, is an intelligent opportunist with a proven business acumen that has previously been used on the wrong side of the law. In recent years, he has been imprisoned and has paid stiff court fines for operating what police have described as sophisticated bawdy house operations in Toronto that yielded large amounts of untraceable cash.

Documents obtained by The Intelligencer reveal 387 investors across North America are now pressing authorities for answers as to why some of the millions of dollars they invested in a new venture with Graves as much as $35 million in total have evaporated along with a failed cheque-cashing and payday loan-advance company he founded in Belleville.

Graves's Cashier Inc., located at 95 College St. East in Belleville, filed for bankruptcy June 7, forcing the company into the hands of receiver BDO Dunwoody Ltd. of Toronto.

In bankruptcy papers, Cashier Inc. president Graves signed his name to 26 pages, each listing noteholders who expected him to earn them as much as 36 to 60 per cent in annual returns on their investments.

Investors now worry they may only get cents on the dollar following a cursory investigation by BDO Dunwoody, which has conducted a preliminary forensic audit of the company's remaining assets versus its liabilities.

In an interview, BDO Dunwoody vice-president Clark McKeown said from Toronto that he couldn't divulge details about the Cashier Inc. meltdown.

There isn't a lot that has become public yet other than the meeting of the creditors, said McKeown. The trustee will not divulge private information.

The meeting McKeown referred to was held June 27 at Belleville's Banquet Hall where 40 of the 387 investors gathered for a private anger-filled bear-pit session with BDO Dunwoody to learn what had happened to their money.

Court-appointed trustee BDO Dunwoody, in its preliminary report, said that when it took possession of the failing company and its assets June 7, Cashier's records were in disarray.

A review of Cashier's noteholder files reflects no consistency or completeness in the form of documentation or written exchanges with these noteholders, stated the report.

The receiver said records were in such poor condition that it will be difficult to distinguish between those for Cashier Inc. and its predecessor company Can-Stop Ltd., also owned by Graves, another Belleville-based cheque-cashing and loans outfit that Graves merged into Cashier Inc.

Making matters more complicated, investors are spread far and wide, said the receiver.

BDO Dunwoody said noteholders who sank cash into the company hail from 50 different Canadian and American provincial and state jurisdictions as well as several foreign jurisdictions... the trustee has been contacted by a number of highly-concerned noteholders, many of whom have alleged that in making their investment, they were seriously misled and/or misinformed. The trustee is also aware of several actions brought by one Canadian and five U.S. state authorities which, in some cases, were charging that violations of securities legislation had been committed.

The claims by BDO Dunwoody of government action on both sides of the border are fact, The Intelligencer has learned.

Belleville police said they are aware of the mounting Cashier Inc. matter but are not investigating, because it falls within the purview of the RCMP.

Unofficially, sources within the RCMP said this week that an investigation has been launched into Cashier Inc. and Can-Stop Ltd. by detectives within the Mounties' commercial crimes unit in Kingston.

Officially, however, RCMP spokeswoman Michele Paradis said from Toronto she cannot confirm publicly if federal police are investigating Cashier Inc. on fraud-related complaints by Canadian investors who claim they have been bilked.

Privacy legislation says we can't divulge if a case is underway, said Paradis.

However, as official spokeswoman for RCMP Ontario region, Paradis confirmed no charges have been laid that I know of against Graves or either of his companies in Canada.

In the U.S., state securities authorities have filed charges in their own jurisdictions against Cashier Inc., Graves and American investment broker Victor Kivisels, president of Florida-based Corporate Funding Group Inc.

According to information compiled by BDO Dunwoody, Kivisels allegedly received 35 per cent in commissions, or roughly $10 million, from money raised by his firm across the continent for Cashier Inc.

In a statement, Washington State securities division assistant director Deborah Bortner said a cease and desist order was issued against Cashier Inc. alleging that the company violated the Washington State Securities Act by offering unregistered securities. Cashier is alleged to have used a Florida telemarketing firm Corporate Funding Inc. to offer Cashier's unregistered securities to Washington citizens.

Cashier Inc., it is alleged in documents obtained by The Intelligencer, sent, or caused to be sent, unsolicited e-mail messages to Washington residents seeking investors. The e-mail messages stated that for a $10,000 investment, investors could make 36 per cent annual returns investing in what the respondents (Cashier) called fully secured accounts receivable acquisitions.'

Bortner said Washington officials launched an undercover sting operation and through an Internet surveillance program identified the (alleged) frauds, then our investigators posed as investors and were solicited by (allegedly) fraudulent telemarketing firms. We then had the evidence we needed to shut down the operations.

In the charges, investigators said a salesperson named Crecelius called one Washington resident who returned an electronic form from a Cashier Inc. e-mail and allegedly said that, contrary to American law which only allows payday loan firms to charge 15 per cent interest per $100 borrowed, Canadian laws allow a charge of up to $30 per $100. As a result, Cashier collected a 780 per cent annual return...

The allegations state that Cashier Inc. and its related parties also made material misrepresentations and omissions in the offer. The cease and desist order seeks restitution for Washington investors, injunctive relief to prohibit future violations and fines of $5,000 against each respondent.

Speaking directly to Cashier Inc.'s promise of high rates of return, Bortner said investors need to be especially cautious about promises of high returns with low risk.

Other state authorities have weighed in for a fight against Cashier Inc., including Pennsylvania and Nebraska.

Thomas Sindelar, an official with the Nebraska Department of Banking and Finance, said his state also issued a cease and desist order against Cashier Inc. to permanently prohibit the further offer of (Cashier's) investments and securities.

Aimee Toth, legal counsel for Pennsylvania state's division of enforcement, litigation and compliance, said her government issued an order against Graves's Cashier Inc. and Can-Stop Ltd. to halt business activities there.

In a statement, Toth said the state logged instances in October 2001 in which Cashier Inc. and Can-Stop advertised on a Pennsylvania radio station for payday advance loans and elsewhere offered investment opportunities.

Offering materials indicate that the minimum investment in the agreements is $10,000 with a 12-month term and the amount of the offering is $1.9 million. The agreements are to pay monthly interest at 3 per cent and they are renewable for one additional 12-month term, said Toth. The agreements issued by Cashier are securities which are not registered with the commission under Sect. 201 of the 1972 Securities Act...

The sales pitches, whatever they were, appear to have worked.

According to a list of creditors compiled by BDO Dunwoody, 75 per cent of the $35 million in investments came from American residents with much of the remaining cash coming from Canadian sources, including some from Quinte.

According to the creditors' list filed in bankruptcy court, the total claim by 387 investors tops $20.7 million. A separate $13 million was paid out in the company's infancy in interest to noteholders.

Locally, as many as 35 investors stand to lose $2.5 million they invested in the failed Cashier Inc. firm, the list reveals.

As is done in similar cases, inspectors,' as they are termed, are appointed under BDO Dunwoody from among the investors to inspect paperwork, act as advisors and liaise with the other investors. While BDO Dunwoody is acting as the trustee, it is consulting with the five inspectors on future decisions to reclaim as many assets as possible.

Surviving Cashier Inc. accounting receipts show that the company only claimed $1.6 million in cash profits of the $35 million in capital raised, and that there was a recorded operating cash loss of $17.8 million.

As of June 7, when BDO Dunwoody assumed control of Cashier Inc., the company still had $5.1 million in assets, including $359,996 in cash, $191,258 in loans receivable from customers in good standing, $3.1 million in delinquent accounts now in collections, and roughly $1.5 million in receivables that appear to be recoverable.

The fact that some assets remain on the books offers little solace to some investors.

Marc Abramsky, one of the appointed inspectors, said he has no idea if he will recoup the $120,000 Cdn he invested in 2000.

In an interview from his home, Abramsky said he shares the feelings of many investors who attended the June 27 meeting in Belleville.

We're all dealing with this feeling of gross betrayal... I believe it was gross misrepresentation that was taking place, said Abramsky, who owns and manages Boat Brokers and Charters in Picton.

Abramsky said he has reviewed the bankruptcy documents concerning Cashier Inc. and, coupled with the apparent loss of his hard-earned cash, he feels he has been a made a fool of.

The feeling is our investment has been lost and we are only going to see cents on the dollars. We have been taken advantage of. It would be good to see justice served here,said Abramsky.

Abramsky said his apparent loss is small compared to other Canadian investors as listed in the creditors documents filed by BDO Dunwoody.

Tom Carmichael of Toronto, another appointed inspector, is wondering if he will ever see any of the $800,000 he invested with Cashier Inc.

And a Belleville company, Invest and Beyond Ltd., is trying to recoup $1.2 million it invested.

Even more troubling for investors in Belleville and beyond is word of Graves's questionable past that never came to light when millions of dollars were pouring in from unsuspecting investors.

Court and police documents show that while operating Can-Stop businesses in the mid- to late-1990s, Graves was also involved in illegal business activities in Toronto.

While Graves was operating his Can-Stop cheque cashing and loan advance operation from a second-floor office in Toronto, phones on the premises were also being used to field calls from Johns looking to have illicit sex in as many as five bawdy houses operated by Graves and associates, a police investigation concluded in 1998.

Det. Bernie Delaney heads the 32 Division Plain Clothes Vice Squad on Yonge Street north of Sheppard Avenue.

In an interview this week, he confirmed he headed up a month-long investigation involving 40 of his officers that probed an elaborate prostitution ring overseen, said Delaney, by Graves and family members.

Hundreds of hours of surveillance, phone taps and detective work uncovered a highly sophisticated network of brothels, said Delaney, that were connected by a labyrinth of call-forwarding phone systems to avoid detection.

Considered an expert on the inner workings of prostitution in Canada, Delaney has cracked more than 1,000 prostitution cases since 1972. He said the Graves's operation was among the most well-planned he has seen to this day.

It was very intricate, very well done, said Delaney from Toronto. I have been with the force for 35 years... and I will tell you, this was within the top handful I have ever seen. This was very well organized.

The challenge for Delaney and his less-experienced officers was tracing phone calls to the actual apartments used to provide illicit sex by an estimated 20 call girls aged 23 to 39.

Advertisements with phone numbers were placed in newspapers, but the phone lines were not connected to the bawdy houses, he said.

Rather, when a caller phoned to procure a prostitute, the calls were call-forwarded as many as five times to different locations, bounced as Delaney said, to avoid police tracing the calls and busting down the doors of the illicit sex locations.

To locate the bawdy houses, undercover officers from 32 Division posed as Johns. Prostitutes, as well as runners in the operation who picked up nightly cash receipts, were trailed. Through around-the-clock observation, Delaney said the bawdy houses were located, raided and all players within the organization were charged.

On May 12, 1998, 10 people were arrested in the raids and 68 charges were laid. Delaney said all pleaded guilty to a variety of offences.

According to Toronto Police case-tracking documents obtained by The Intelligencer, Graves himself was arrested seven days later and charged with a string of offences including keeping a common bawdy house, permitting premises to be used as a bawdy house, procuring illicit sex, and living on the avails of prostitution.

Disposition papers show Graves pleaded guilty to several of the charges when he appeared in court, having served 14 days in pretrial custody. He was given an intermittent sentence of 90 days incarceration in a provincial detention centre.

Graves was also ordered by the Toronto court to pay $50,025 in fines.

Delaney confirmed that, at the time of arrest, the investigation estimated the bawdy house operation may have raised as much as $1 million in revenues in as little as two years.

Graves could not be reached by The Intelligencer at his home or by telephone.

In a Jan. 29, 2003, letter to investors, however, Graves defended the failing situation of his company.

The last six months have been very difficult due to investors payouts. We have also had $3.7 million in bad debt. Most of the $3.7 million will come back to us, but this takes time, he wrote.

Cashier has had too much in payouts in the last six months and this has depleted our cash flow leaving us in a position that we are unable to meet our obligations to our investors.

Mondial

St. Michael

Barbados