- Report: #1474372

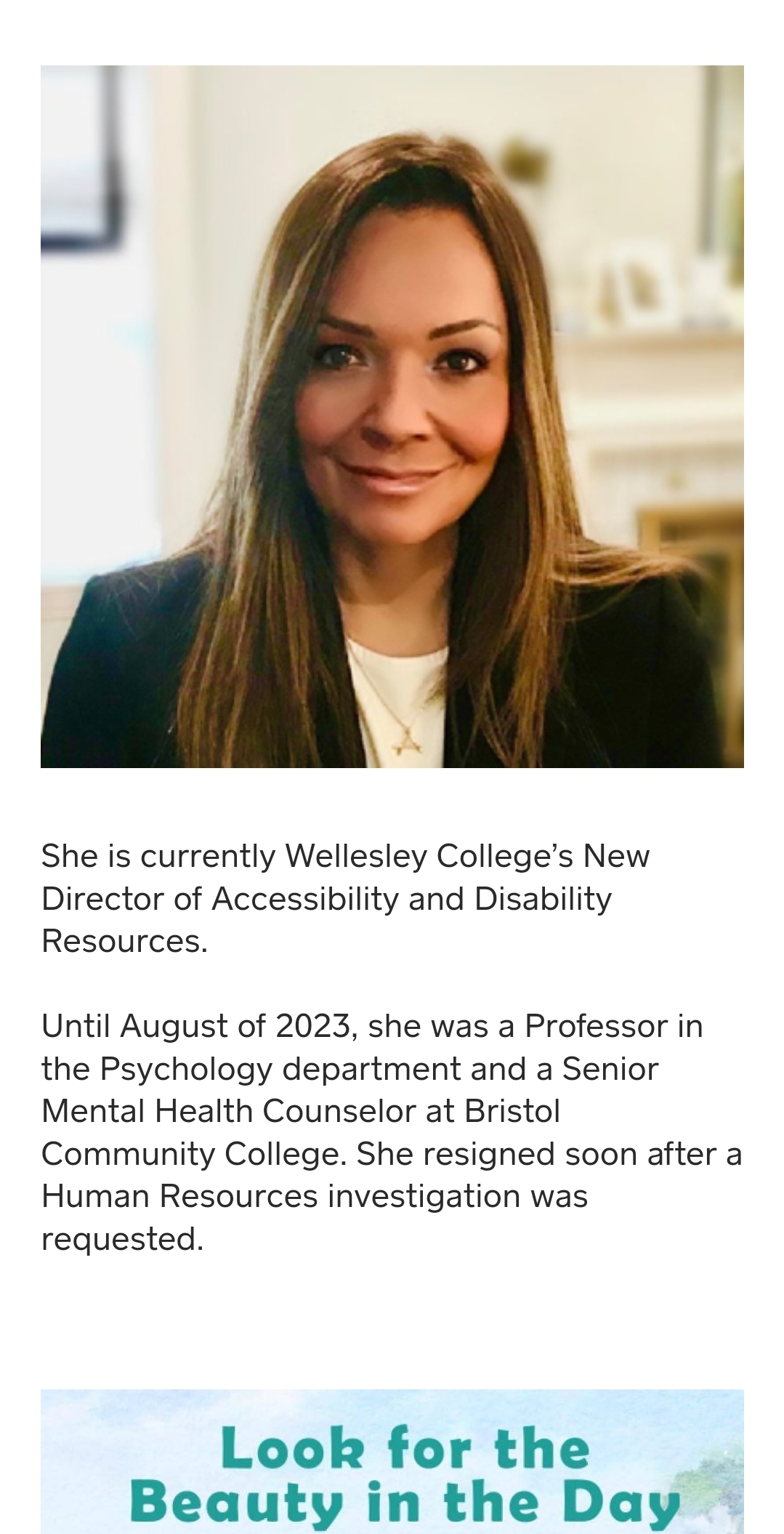

Complaint Review: Monica Schiera Main - Valencia CA

Monica Schiera Main Monica Main Global Success Monica MainGlobal Success Mail Order Investment Trading Course Fraud Valencia CA

Monica Main is selling another trading course after being fined and sent to jail by the CFTC.

She is using a pen name of Peter Barrington to get around the government legal action.

Then Monica tries to scam buyers with her flimsy Money Back Guarantee.

"IMPORTANT NOTICE: There is a 60-Day Money-Back Guarantee on This Product Provided That The Return Comes Into Our Warehouse 60 Days or Less From the Dates of Your Receipt. Please Note That No Refunds Can Be Honored If the System is Damaged, Non-Resellable, and/or Any of the Noted Components Are Opened. Thank You!"

Details below on the CFTC.

--

VALENCIA – She called herself a millionaire who could help customers make a mint trading commodity futures, but Monica Schiera Main kept it a secret that she was a convicted felon who had gone bankrupt.

Federal prosecutors say the business Main operated with her husband, Brian Main, was a fraud, and now a judge has ordered the Valencia couple to pay a $1.5 million penalty as part of an injunction.

More than 1,200 customers signed on to use the bogus trading system the Mains were peddling, and they lost a total of $3 million, according to the Commodity Futures Trading Commission. The couple has been prohibited from further commodity trading.

“It was a scheme of providing misleading advertising and solicitations that injured a large number of customers, over 1,000 customers,” said Scott Williamson, deputy regional counsel for the CFTC, a federal agency.

“And so that’s exactly why the CFTC had to get involved to secure an injunction against future actions of this nature,” Williamson said.

The couple operated the fraud, which involved a bogus software program called Trade Pro and “boot camp” training seminars, from 2001 to 2005, according to the CFTC. Despite Monica Main’s false claims to clients that she was a millionaire, she actually lost money with the small amounts she traded, and she went bankrupt in 2003, according to court records.

Under the Commodity Exchange Act, the Mains should have informed customers about Monica Main’s bankruptcy and her felony conviction.

The Mains could not be reached for comment, and their attorney declined to talk about their future plans or whether they regret their actions.

Fearing a loss of business, the couple failed to inform clients that Monica Main had been convicted of felony mail and wire fraud in connection with an advance-fee loan scam, according to court records.

The Mains created a company called Gemancer Inc., naming it after a combination of their astrological signs of Gemini and Cancer, court records state.

They also created other companies, including Moni Inc., Body Blasters Inc. and Tri Lynx Inc., allegedly to siphon funds from Gemancer. In December, a federal judge ordered the companies owned and controlled by the Mains to pay $12.5 million, including a $9 million penalty and the $3 million that customers lost.

But the money is unlikely to be obtained because the companies are defunct, Williamson said.

“It’s essentially an empty judgment,” he said. “I don’t believe we’ll be able to collect from the companies.”

The Mains used mass mailers and Web sites to solicit business. They minimized the risks of commodity futures trading, and Monica Main told potential clients that she was “consistently profiting over 90 percent” on her trades. In reality, she lost money with her trading accounts, which only had a few thousand dollars each, court records state.

As for Gemancer’s trading advice, it was a “recipe for losses,” and the Trade Pro software “simply did not work,” prosecutors said in a court document.

Customers who used the system would have traded on their own, so the CFTC cannot compensate them for their losses with the judgment against the Mains.

“We don’t know what experiences they may have had,” Williamson said. “We just don’t believe that there’s a likelihood that trading was profitable.”

https://www.cftc.gov/PressRoom/PressReleases/pr5331-07

https://www.monicamain.com/the_slice

https://www.monicamain.com/