- Report: #1497445

Complaint Review: Ally Auto Finance - Detroit Michigan

Ally Auto Finance Ally financial SCAM ARTIST TARGETING DIVERSE COMMUNITIES Detroit Michigan

*Consumer Comment: Ally isn't the problem

*Consumer Comment: Not a Scam

*Author of original report: ALLY IS THE PROBLEM AND FAILS TO TAKE RESPONSIBILITY REFERENCE DISTRICT COURT DOC

*Author of original report: ALLY IS A DISCRIMINATORY LENDER THAT WONT TAKE RESPONSIBILITY

*Consumer Comment: Relevancy?

*Author of original report: RACIST

*Author of original report: DO NOT USE ALLY SCAMMERS

*General Comment: And what do you think the ACLU will do?

I financed a vehicle through Ally Auto. Worst mistake of my life and here is why. Ally Auto indicated to my that they would refinance my outrageously high intrest rate of 17% after i made my first 3 timley payments this was an outright lie. Then the vehcile i was sold was a a lemon i notifed Ally to not realse funds to the dealer but they did.

Then they destroyed my credit when i refused to make payments until they made good on thier promise. This instituion targets impvivershied diverse communites who do not understand creidt and financing they abuse and rape these communites of thier hard earned money. Countless calls and arguments have led nowhere they are useless. BOYCOTT ALLY

8 Updates & Rebuttals

John

Takoma Park,United States

And what do you think the ACLU will do?

#2General Comment

Fri, July 23, 2021

"YOUR RACIST SUGESTIVE REMARKS WILL BE REPORTED TO THE ACLU." Which will educate you on America's excellent Freedom of Speech protections.

Tod

matawan,New Jersey,

United States

DO NOT USE ALLY SCAMMERS

#3Author of original report

Sun, July 12, 2020

Do not use ally financial they are scam artists. Look at reviews of this looser company before financing anything with them. Unethical unprofessional racist arrogant company buyer beware

coast

United StatesRelevancy?

#4Consumer Comment

Sun, July 12, 2020

Are you one of the overcharged African-American, Hispanic, Asian or Pacific Islander customers that obtained a loan from Ally Financial or Ally Bank between April 2011 and December 2013? If not, then the settlement is not relevant to your case.

Tod

matawan,New Jersey,

United States

ALLY IS A DISCRIMINATORY LENDER THAT WONT TAKE RESPONSIBILITY

#5Author of original report

Sat, July 11, 2020

YOUR RACIST SUGESTIVE REMARKS WILL BE REPORTED TO THE ACLU. STATING MY INTRREST RATE IS PROBABLY EVEN HIGHER NOW WHAT ARE YOU SUGGESTING??????? THIS IS EXACLTY WHAT THE ATTACHED COURT DOCUMENT EXPLAINS THE ARRONGANCE AND DISCRINMATORY LENDING YOUR REPONSE IS A PERFECT TESTAMENT TO HOW THIS COURT DOCUMENT, AND WHAT I HAVE BEEN STATING ALL ALONG.

BY THE WAY THE LOAN WITH ALLY IS PAID OFF IN FULL I DROPPED YOUR INCOMPETENT COMAPNY LIKE A BAD HABIT AND WENT OVER TO CAPITAL ONE WHICH A MUCH BETTER RATE. ALLY IS A BOTTOM OF THE BARELL LENDER WITH ILLIGIMATE PRACTICES AND YOUR REPONSE AND THIS ATTACHED DOCUMET IS A TRUE TESTAMENT TO WHAT IVE BEEN DEALING WITH.

Tod

matawan,New Jersey,

United States

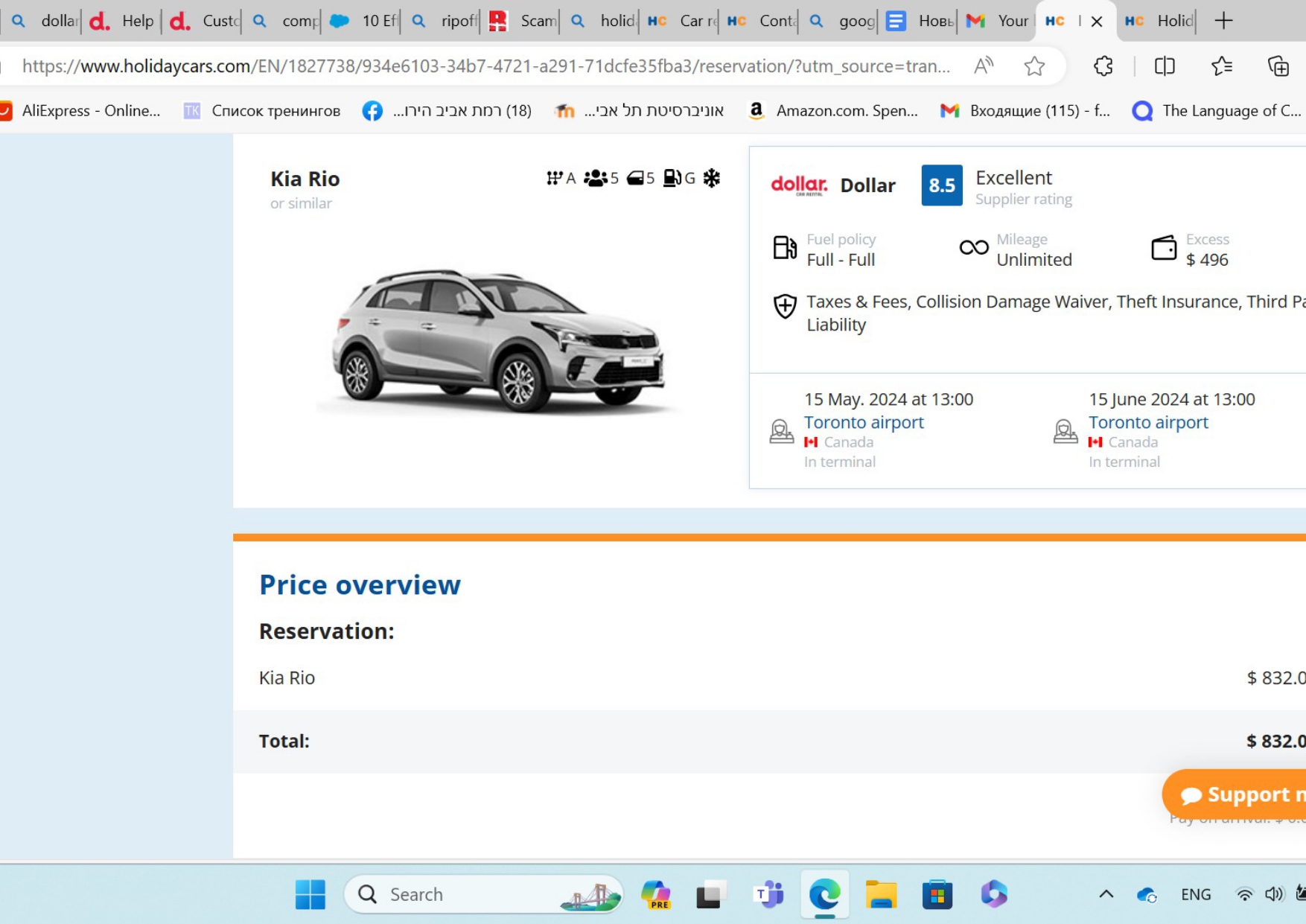

ALLY IS THE PROBLEM AND FAILS TO TAKE RESPONSIBILITY REFERENCE DISTRICT COURT DOC

#6Author of original report

Sat, July 11, 2020

ALLY IS STILL FAILING TO TAKE RESPOSBILTY FOR ITS DECPTION. WERE YOU THIER AT THE TIME THE LOAN WAS SIGNED NOO DO YOU KNOW THE HISOTRY OF PROBLEMS I HAVE HAD NOOO. ALSO BELOW FIND THE DISTRICT COURT DOCKET WHERE ALLY WAS FOUND GUILTY OF DOING EXACLTY WHAT I AM STATING. THE INTREST RATE WAS NOT REFLECTIVE OF MY CREDIT AND WAS INFLATED. PLEASE VIEW THE BELOW DISTRICT COURT DOCUMENT AND EDUCATE YOOURSELF BEFORE YOU SPEAK. ALLY HAS BEEN PRACTICING DISCRIMINATORY LENDING PRACTICES IN THE PAST. ALSO ALLY REFUSES TAKE ANY RESPONSIBILTY FOR THIER WRONG DOING. ITS ALL EXUSES AND LIES NO WONDER ALLY HAS A 1 STAR CUSTOMER REVIEW/SATISFACTION RATING I AM NOT THE ONLY ONE WHO HAS BEEN BURNED. BOYCOTT ALLY

1

IN THE UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

UNITED STATES OF AMERICA, )

)

Plaintiff, ) CIVIL ACTION NO.

)

v. )

)

ALLY FINANCIAL INC. )

and ALLY BANK, )

)

Defendants. )

_____________________________________________)

COMPLAINT

1. The United States of America brings this action against Ally Financial Inc. and

Ally Bank (collectively, “Ally”) for discriminating against thousands of African-American,

Hispanic, and Asian/Pacific Islander borrowers across the United States who have obtained loans

from Ally to finance automobiles. The discrimination is caused by Ally’s policy and practice

that allows dealers to include markups in the interest rates on automobile loans in a hidden

manner not based on the borrower’s creditworthiness or other objective criteria related to

borrower risk. The United States brings this action to enforce provisions of the Equal Credit

Opportunity Act (ECOA), 15 U.S.C. §§ 1691-1691f, and its implementing regulation, Regulation

B, 12 C.F.R. Part 1002.

2. Between April 2011 and the present, this system caused approximately 100,000

African-American borrowers, 125,000 Hispanic borrowers, and 10,000 Asian/Pacific Islander

borrowers to pay Ally higher interest rates for their automobile loans than non-Hispanic white

(“white”) borrowers because of their race or national origin and not based on their

creditworthiness or other objective criteria related to borrower risk. The average AfricanAmerican victim was obligated to pay over $300 more during the term of the loan because of

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 1 of 13 Pg ID 1

2

discrimination, and the average Hispanic and Asian/Pacific Islander victim was obligated to pay

over $200 more during the term of the loan because of discrimination.

3. Ally is one of the largest automobile lenders in the United States. In 2012, Ally

was the leading funder of automobile loans through franchised dealers in the United States

among lenders not owned by an automobile manufacturer. Since April 2011, Ally funded nearly

three million loans through over 12,000 automobile dealers nationwide. During the first nine

months of 2013, Ally funded more than $20 billion in automobile loans. Ally Bank is also one

of the nation’s twenty-five largest banks, with more than $90 billion in assets.

4. Ally sets an interest rate for each loan it approves based on the consumer’s

creditworthiness and other objective criteria related to credit risk. From at least April 2011 and

continuing to the present, Ally has maintained a specific policy and practice that allows

automobile dealers to then mark up that risk-based interest rate in ways that are not connected to

the consumer’s creditworthiness or other objective criteria related to borrower risk.

5. Ally typically retains a portion of the profits earned from this interest rate markup

and pays the remainder to dealers. As a result, Ally’s policy and practice creates financial

incentives for dealers to mark up borrowers’ interest rates above those established based on the

consumer’s creditworthiness or other objective criteria related to borrower risk.

6. From at least April 2011 and continuing to the present, Ally has not provided

adequate constraints or monitoring across its portfolio of loans to prevent discrimination from

occurring through charging markups despite knowing or having reason to know that its policy

and practice of allowing dealers to mark up consumers’ interest rates creates a substantial risk of

discrimination. Ally conducted no monitoring of markup disparities until March 2013, and its

monitoring since then has been entirely inadequate.

7. As a result of Ally’s dealer markup and compensation policy and practice and its

lack of compliance monitoring, African-American, Hispanic, and Asian/Pacific Islander

borrowers paid higher interest rates for their automobile loans than white borrowers, not based

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 2 of 13 Pg ID 2

3

on creditworthiness or other objective criteria related to borrower risk, but because of their race

and national origin.

8. The United States brings this lawsuit to hold Ally accountable for its serious

violations of law and to remedy the substantial and widespread harmful consequences of its

discriminatory lending policy and practice.

9. This Court has jurisdiction pursuant to 15 U.S.C. § 1391e(h) and 28 U.S.C.

§ 1345. Venue is proper in this District under 28 U.S.C. § 1391.

PARTIES

10. The United States is authorized to initiate a civil action in federal district court

whenever a matter is referred to the Attorney General pursuant to 15 U.S.C. § 1691e(g) or the

Attorney General has reasonable cause to believe that a pattern or practice in violation of the

ECOA has occurred. 15 U.S.C. § 1691e(h).

11. Defendant Ally Financial Inc. is a bank holding company, incorporated in the

State of Delaware with a principal place of business in the State of Michigan. Ally Financial Inc.

was known as GMAC, Inc. until 2010. As of September 30, 2012, Ally Financial Inc. had $151

billion in total assets, and it is subject to examination by the Consumer Financial Protection

Bureau (“CFPB”).

12. Defendant Ally Bank is a subsidiary of Defendant Ally Financial Inc. Ally Bank

is chartered by the State of Utah and has deposits that are insured by the Federal Deposit

Insurance Corporation. As of September 30, 2013, Ally Bank had $92.1 billion in total assets,

and it is subject to examination by the CFPB.

13. Both Defendants conduct their automobile lending in a coordinated and identical

manner, using common policies and practices.

14. Ally funds purchases of automobiles through a model known as “indirect

lending.” A consumer can use one of two methods to finance an automobile purchase: (1)

“direct lending” in which the consumer applies directly to the institution underwriting, setting the

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 3 of 13 Pg ID 3

4

terms of, and funding the loan, or (2) “indirect lending” in which the automobile dealer submits

the consumer’s loan application to the institution underwriting, setting the terms of, and funding

the loan. In indirect lending, the loan takes the form of a “retail installment contract,” which the

consumer signs at the time he or she purchases the automobile. In turn, the indirect lender

purchases the retail installment contract from the dealer soon after the automobile sale on terms

set by the lender.

15. Although Ally has agreements with several automobile manufacturers to pay Ally

in order to subsidize some or all of the interest payments in order to boost sales of the

manufacturer’s models, the majority of Ally’s loans are made without such subsidies. Loans

made without a manufacturer subsidy are known as “non-subvented loans”.

16. Ally also has agreements with each of the over 12,000 individual automobile

dealers. These agreements established the terms under which Ally will fund automobile loans by

purchasing retail installment contracts from the dealers, including dealer compensation for

arranging the loan. These agreements specify narrow circumstances in which Ally can force a

dealer to repurchase a retail installment contract or reimburse Ally for loan default or

prepayment.

17. Ally’s agreements with automobile dealers specify that Ally will purchase only

retail installment contracts that are acceptable to Ally and at interest rates specified by Ally. As

part of deciding whether the loan is acceptable, Ally takes responsibility for determining the

creditworthiness of each consumer. Ally’s agreements also require dealers to provide consumers

with a disclosure that explains that their loan application is being submitted for Ally’s decision

on whether or not to purchase the loan.

18. Ally’s agreements with automobile dealers require that all loan applications they

submit to Ally must comply with the policies, conditions, and requirements that Ally sets for

dealers.

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 4 of 13 Pg ID 4

5

19. Both Defendants are creditors within the meaning of the ECOA, 15 U.S.C.

§ 1691a(e), and Regulation B, 12 C.F.R. § 1002.2(l). Both Defendants regularly participate in

the decision to extend credit through taking responsibility for underwriting retail installment

contracts, regularly participate in setting the terms of credit by establishing interest rates and

communicating those rates to automobile dealers for inclusion in retail installment contracts, and

influence credit decisions by indicating to dealers whether or not they will purchase retail

installment contracts.

INVESTIGATION

20. In September 2012, the CFPB began an examination of the indirect automobile

lending practices of Ally from April 1, 2011 to March 31, 2012. The examination included an

evaluation of Ally’s compliance with fair lending laws and regulations in its indirect automobile

lending program.

21. The CFPB analyzed Ally’s lending policies, procedures, and internal controls,

including Ally’s dealer markup and compensation policy and practice from April 2011. The

Bureau also performed an analysis of Ally’s loan-level data on the automobile loans Ally funded

between April 1, 2011 and March 31, 2012 to test for lending discrimination.

22. After providing Ally with an opportunity to respond to the results of the CFPB’s

analysis, the CFPB determined it had reason to believe that Ally had engaged in a pattern and

practice of lending discrimination on the basis of race and national origin in violation of the

ECOA, 15 U.S.C. § 1691(a)(1). The CFPB referred Ally to the United States Department of

Justice pursuant to the ECOA, 15 U.S.C. § 1691e(g), and the December 6, 2012 Memorandum of

Understanding between the United States Department of Justice and the CFPB.

23. Based on the CFPB referral, the Department of Justice has engaged in an

investigation of Ally’s indirect automobile lending policies, practices, and procedures, including

reviewing Ally’s loan-level data on the more than 1.21 million automobile loans Ally funded

between April 1, 2011 and March 31, 2012.

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 5 of 13 Pg ID 5

6

FACTUAL ALLEGATIONS

24. To determine whether it will fund a loan, and on what terms, Ally conducts an

underwriting process on each loan application submitted by one of its dealers on behalf of a

consumer. As part of the underwriting, Ally uses a proprietary system of credit scoring to assign

one of six credit tiers to the applicant, or applicants, receiving each loan it approves for funding.

25. From at least April 2011, and continuing to the present, Ally periodically sets a

specified “buy rate” for the loans it funds. Ally determines the buy rate for each loan based on

its current cost of funds plus adjustments to reflect the borrower’s creditworthiness and other

objective criteria related to borrower risk. These adjustments use a proprietary underwriting and

pricing model to account for the consumer’s credit risk, as reflected in the assigned credit tier,

and also consider whether the automobile is new or used and the length of the loan. The dealers,

but not the consumers, learn the buy rate. The buy rate reflects the minimum interest rate, absent

a special payment to Ally from the dealer, for a non-subvented loan that Ally will fund.

26. From at least April 2011, and continuing to the present, Ally has maintained a

specific policy and practice, reflected in its agreements with individual dealers, that allows

dealers to mark up a consumer’s interest rate above Ally’s established buy rate, and that

compensates dealers from the increased interest revenue to be derived from the markup . It is

Ally’s specific policy and practice to permit dealers to mark up the buy rate for reasons not

related to the borrowers’ creditworthiness or other objective criteria related to borrower risk.

Ally capped the dealer markup to 250 basis points for loans with terms of 60 monthly payments

or less and to 200 basis points for loans with terms of greater than 60 monthly payments or for

loans to borrowers assigned to the lowest two tiers of Ally’s proprietary system of credit scoring.

A basis point is a percentage of the total amount of a loan, with one hundred basis points

equaling one percent of the loan amount.

27. The ECOA limits the collection of self-identified race and ethnic data for

automobile loans. 12 C.F.R. § 1002.5(b) (prohibiting the collection of race or national origin

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 6 of 13 Pg ID 6

7

data from a non-mortgage loan applicant, except in the case of a creditor’s self-test for ECOA

compliance). Information about the race and ethnicity of borrowers on automobile loans that

Ally funded can be calculated based on public data published by the United States Census

Bureau for the race and ethnicity of individuals with the same surname and for the race and

ethnicity of individuals living in the same neighborhood, using a process called the Bayesian

Improved Surname Geocoding (BISG) method. The BISG method builds on the fact that many

surnames in the United States are predominantly associated with a particular race or ethnicity—

especially for Hispanic and Asian/Pacific Islander individuals—and that many neighborhoods

are segregated by race and ethnicity—especially neighborhoods where African Americans live.

28. The BISG method is recognized by social scientists, statisticians, and economists

as a tested and accurate way to determine differences in experiences based on race or ethnicity

for large groups of individuals for whom self-identified race and ethnicity data is not available.

29. Statistical analyses of non-subvented automobile loans Ally funded through

purchasing retail installment contracts between April 1, 2011 and March 31, 2012, using the

BISG method to identify race and national origin demonstrate statistically significant

discriminatory pricing disparities based on race and national origin. Statistical significance is a

measure of probability that an observed outcome would not have occurred by chance. As used in

this Complaint, an outcome is statistically significant if the probability that it could have

occurred by chance is less than 5%. During the time period covered by the analyses, Ally funded

over 800,000 non-subvented loans, of which nearly 200,000 had African-American, Hispanic, or

Asian/Pacific Islander borrowers or co-borrowers.

30. During the time period covered by the analyses, on average, Ally charged

African-American borrowers more than white borrowers in interest rate markups not based on

creditworthiness or other objective criteria related to borrower risk. The disparity was

approximately 29 basis points for non-subvented loans, and it is statistically significant.

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 7 of 13 Pg ID 7

8

31. These disparities mean that African-American borrowers affected by the

discrimination were obligated to pay, on average, over $300 more in interest than white

borrowers over the life of their loans not based on creditworthiness or other objective criteria

related to borrower risk.

32. During the time period covered by the analyses, on average, Ally charged

Hispanic borrowers more than white borrowers in interest rate markups not based on

creditworthiness or other objective criteria related to borrower risk. The disparity was

approximately 20 basis points for non-subvented loans, and it is statistically significant.

33. These disparities mean that Hispanic borrowers affected by the discrimination

were obligated to pay, on average, over $200 more in interest than white borrowers over the life

of their loans not based on creditworthiness or other objective criteria related to borrower risk.

34. During the time period covered by the analyses, on average, Ally charged

Asian/Pacific Islander borrowers more than white borrowers in interest rate markups not based

on creditworthiness or other objective criteria related to borrower risk. The disparity was

approximately 22 basis points for non-subvented loans, and it is statistically significant.

35. This disparity means that Asian/Pacific Islander borrowers affected by the

discrimination were obligated to pay, on average, over $200 more in interest than white

borrowers over the life of their loans not based on creditworthiness or other objective criteria

related to borrower risk.

36. From at least April 2011, and continuing to the present, in setting the terms and

conditions for the automobile loans it funds, Ally accounts for individual borrowers’ differences

in creditworthiness and other objective criteria related to borrower risk by setting the buy rate as

explained in Paragraph 25. The interest rate markups charged by Ally to consumers are separate

from, and not controlled by, the adjustments for creditworthiness and other objective criteria

related to borrower risk already reflected in the buy rate. No Ally policy directs dealers to

consider creditworthiness or other objective criteria related to borrower risk for a second time,

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 8 of 13 Pg ID 8

9

after they had already been considered in setting the buy rate, in determining interest rate

markups. Accordingly, the racial and ethnic interest rate markup disparities described in

Paragraphs 30-35 are not adjusted for creditworthiness and other objective criteria related to

borrower risk.

37. For the reasons described in Paragraph 36, it is not proper to include factors

measuring creditworthiness and other objective criteria related to borrower risk in the statistical

analysis of interest rate markup disparities. Nevertheless, statistical analyses of Ally’s interest

rate markups during the time period covered by the analyses that control—both separately and in

concert through regression—for creditworthiness and risk-related factors such as credit tier,

new/used status, and loan length demonstrate a similar pattern of racial and ethnic interest rate

markup disparities, with the magnitude only somewhat diminished from the disparities described

in Paragraphs 30-35. Thus, accounting for creditworthiness or other objective criteria related to

borrower risk a second time does not explain the racial and ethnic interest rate markup

disparities, even if those factors were relevant to the subjective pricing adjustments measured by

interest rate markups.

38. The analysis described in Paragraph 37 that separately controls for which one of

the six tiers of Ally’s proprietary system of credit scoring to which Ally assigned the borrower

determined that Ally discriminates most severely against those borrowers it classifies as the most

creditworthy by its proprietary system of credit scoring. Ally had greater racial and ethnic

interest rate disparities for borrowers in the best credit tier than in any of the other credit tiers. In

other words, Ally’s most qualified African-American, Hispanic and Asian/Pacific Islander

borrowers with the least credit risk suffer the most discrimination.

39. Additionally, statistical regression analyses of Ally’s lending data that control for

multiple creditworthiness and risk-related factors such as credit tier, new/used status, and loan

length, also demonstrate that the racial and ethnic disparities in interest rate markup described in

Paragraphs 30-35 produced racial disparities, compared to similarly situated white borrowers, in

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 9 of 13 Pg ID 9

10

the annual percentage rate of interest Ally charged that cannot be explained by creditworthiness

and risk-related factors. Thus, accounting for creditworthiness and risk-related factors does not

explain the racial and ethnic disparities in the interest rate paid by the borrower, even if those

factors were relevant to the subjective pricing adjustments measured by interest rate markup.

40. The higher markups that were charged to African-American, Hispanic, and

Asian/Pacific Islander borrowers for the subject loans are a result of Ally’s specific policy and

practice of allowing dealers to mark up a consumer’s interest rate above Ally’s established buy

rate and compensating dealers from that increased interest revenue.

41. Ally’s specific policy and practice of allowing dealers to mark up a consumer’s

interest rate above Ally’s established buy rate and compensating dealers for those markups has

continued from April 2011 to the present.

42. During this period, Ally has not required dealers to document reasons for

charging markups, it has not monitored whether discrimination occurred across its portfolio of

loans through charging markups, and Ally has not at all times provided detailed fair lending

training to its dealers.

43. Ally conducted no monitoring for lending discrimination in interest rate markups

before March 2013.

44. The fair lending monitoring system that Ally established in March 2013—after

receiving notice of the CFPB’s preliminary finding of discrimination—reviews for large interest

rate markup disparities only within individual dealers, and only for dealers from which it buys at

least five minority and five white loans during the previous six months. The monitoring program

does not review company-wide disparities across its portfolio of loans, and also misses many

sizeable and statistically significant within-dealer disparities. During the first round of reviews

under the program, Ally identified only 21 of its over 12,000 dealers with possible markup

disparities warranting further analysis, and it ultimately determined that only two dealers would

be subject to any corrective action. Those two dealers were subject only to voluntary education,

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 10 of 13 Pg ID 10

11

which involves making the dealer aware of potential liability under the ECOA and providing

voluntary training regarding the ECOA.

45. Ally’s specific policy and practice are not justified by a legitimate business need

that cannot reasonably be achieved as well by means that are less disparate in their impact on

African-American, Hispanic, and Asian/Pacific Islander borrowers.

46. Ally knew or had reason to know that its policy and practice of allowing dealers

to mark up consumers’ interest rates creates a substantial risk of discrimination. Ally has not

taken effective action to change the discriminatory policy and practice or to identify and

compensate victims of the discrimination.

EQUAL CREDIT OPPORTUNITY ACT VIOLATIONS

47. Ally’s policies and practices, as alleged herein, constitute discrimination against

applicants with respect to credit transactions on the basis of race and national origin in violation

of the Equal Credit Opportunity Act, 15 U.S.C. § 1691(a)(1).

48. Ally’s policies and practices, as alleged herein, constitute a pattern or practice of

resistance to the full enjoyment of rights secured by the Equal Credit Opportunity Act, 15 U.S.C.

§§ 1691-1691f.

49. Between April 2011 and the present, Ally has charged over a quarter of a million

consumers nationwide discriminatory interest charges for automobile loans as a result of its

pattern or practice of discrimination and denial of rights as alleged herein. In addition to higher

direct economic costs, some of the victims of discrimination suffered additional consequential

economic damages resulting from having an excessively costly loan, including possible

increased risk of credit problems, default, and repossession, and other damages, including

emotional distress. They are aggrieved applicants as defined in the Equal Credit Opportunity

Act, 15 U.S.C. § 1691e, and have suffered injury and damages as a result of Ally’s conduct.

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 11 of 13 Pg ID 11

12

50. Ally’s policies and practices, as alleged herein, were intentional, willful, or

implemented with reckless disregard for the rights of African-American, Hispanic, and

Asian/Pacific Islander borrowers.

51. The ECOA empowers this Court to grant such relief as may be appropriate,

including actual and punitive damages and injunctive relief. 15 U.S.C. § 1691e(h).

PRAYER FOR RELIEF

WHEREFORE, the United States prays that the Court enter an ORDER that:

(1) Declares that the policies and practices of the Defendants constitute violations of the

Equal Credit Opportunity Act, 15 U.S.C. §§ 1691-1691f;

(2) Enjoins the Defendants and their agents, employees, and successors, and all other

persons in active concert or participation with them, from:

a) Discriminating on the basis of race or national origin against any person with

respect to any aspect of their credit transactions;

b) Failing or refusing to take such affirmative steps as may be necessary to

restore, as nearly as practicable, the victims of the Defendants’ unlawful conduct

to the position they would have been in but for the discriminatory conduct; and

c) Failing or refusing to take such affirmative steps as may be necessary to

prevent the recurrence of any such discriminatory conduct in the future; to

eliminate, to the extent practicable, the effect of Ally’s unlawful practices; and to

implement policies and procedures to ensure that all borrowers have an equal

opportunity to seek and obtain loans on a non-discriminatory basis and with

non-discriminatory terms and conditions; and

(3) Awards equitable relief and monetary damages to all the victims of the Defendants’

discriminatory policies and practices for the injuries caused by the Defendants, including direct

economic costs, consequential damages, and other damages, pursuant to 15 U.S.C. § 1691e(h).

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 12 of 13 Pg ID 12

2:13-cv-15180-AJT-MAR Doc # 1 Filed 12/20/13 Pg 13 of 13 Pg ID 13

Report Attachments

Tod

matawan,New Jersey,

United States

RACIST

#7Author of original report

Sat, July 11, 2020

Yes I am and that’s is none of your business now you are racial profiling. The racism and targeting continues with your responses I will be expecting a swift resolution on this matter I have contacted legal counsel. Ally refuses to accept Any wrong doing or responsibility and your comments are a written testament to the i professionalism and lack of responseibilty that I have been dealing with all along not to mention the discriminatory comments. Now you are questioning my racial background???? Really ??

coast

United StatesNot a Scam

#8Consumer Comment

Sat, July 11, 2020

"Ally Auto indicated to my that they would refinance my outrageously high intrest rate"

An indication is not an agreement or a contract. Your dissatisfaction with the interest rate is a case of buyer’s remorse.

"they destroyed my credit when i refused to make payments"

Incorrectly stated. YOU damaged your credit by refusing to submit payments. A high interest rate of 17% indicates your credit was already weak at the time of the loan agreement. The interest rate on your next loan will be sky-high.

Robert

Irvine,California,

United States

Ally isn't the problem

#9Consumer Comment

Sat, July 11, 2020

Ally is a bank, the only thing they do is loan the money to enable you to purchase the car.

Dealers will often tell people with bad credit that you can "refinance" after a certain amount of time, so that you will buy the car. Technically they are correct, but there is no guarantee. As for being sold a "Lemon". You didn't describe the car, but I would bet that it was a USED car and you bought it "As-Is". Unless you have something in writing that means that anything everything that goes wrong is 100% your responsibility. If you have any issues with the car you need to take it up with the dealer.

But this has no affect on the loan. Regardless of the condition of the car, or even if you still have the car, you still are required to fulfill your obligation on the loan. There is NOTHING in the loan that says you can withhold payments.

I do like how you state you told Ally not to dispurse the funds...like you actually have a say in that. YOU signed an agreement with the dealer to purchase the car, and Ally made an agreement to pay the dealer. Had Ally failed to dispurse the funds, they would be liable to the dealer. Not only that the dealer since they have your agreement to buy the car would come after you. You would still owe the money...just to a different company.

The only promise here that was broken was your promise to make your payments.

In the end the only one who destroyed your credit is you. But if all you could get was a 17% interest rate, your credit was already destroyed. But let me guess..that wasn't your fault either? Seems like you have a pattern of delinquency and trying to walk away from your debts.